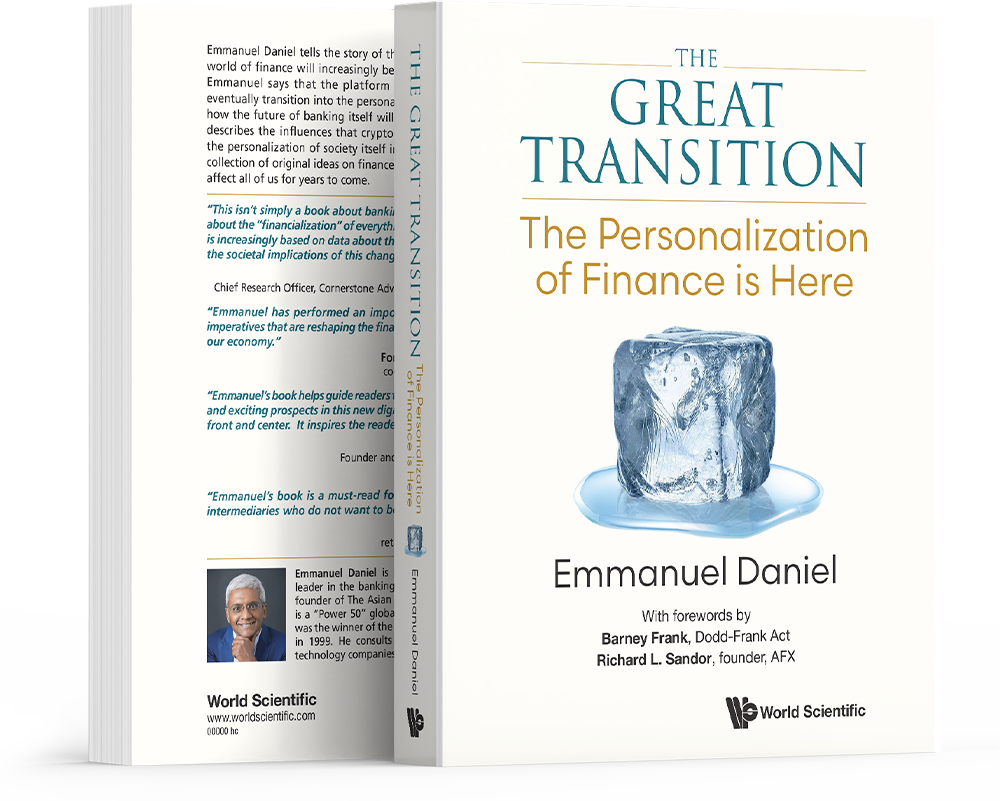

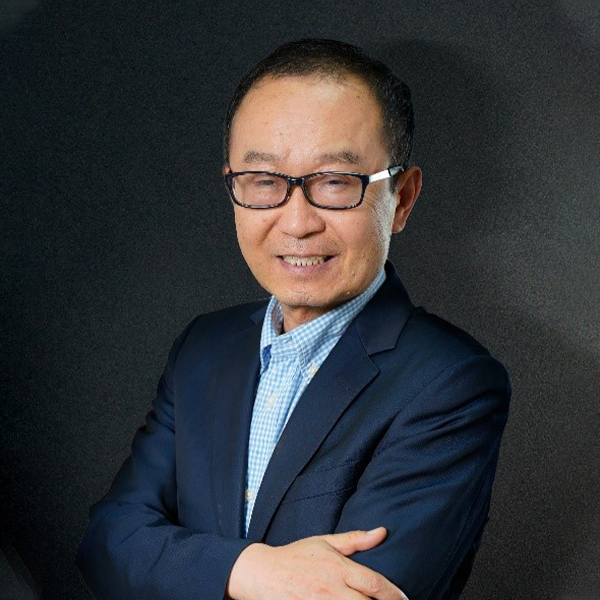

The Great Transition

The Personalization of Finance is Here

This book outlines the transition that the finance industry will go through from its platform stage today into what Emmanuel Daniel calls the “Personalization of Finance”. He uses the story of the ice trade to describe a level of personalization never seen before. It will have a profound effect on how institutions, markets, and societies will need to function in the network age. He introduces the term "financialization of everything" to describe how digitization will transform entire economies, enhance their receptivity towards cryptocurrencies and blockchain, and how new trends such as gaming will shape the personalization of society. This book is especially useful for founders, disruptors and policy makers in finance looking for original ideas on finance, economics, and society shaping the industry today.

Table of contents

Table of Contents 5

Foreword by Barney Frank 7

Foreword by Richard Sandor 9

Preface – The Story of Ice 11

1. From platforms to personalization 15

- The industrialization of finance 16

- Even mobile will end 19

- Mapping the transitions 22

2. The personalization of finance 27

- In search of the ‘CFC’ of finance 27

- Whoever controls identity, controls finance 28

- If energy is the currency of the universe 31

- The game changers 35

3. The financialization of everything 39

- The financialized corporation 40

- Almost anything can be financialized 43

- Say goodbye to the real economy 45

- When perception becomes reality 46

4. Rise of the rebels 51

- The mass amateurization of finance 52

- The hyper-personalization of APIs 56

- Crypto’s WiFi moment 59

5. The agents of change 63

- People shape people 64

- The power of the ‘dysfunctional’ state 67

- The “fifth estate” 70

- The geek army 75

- The venture capitalists 78

6. The anatomy of innovation 83

- The post-Bretton Woods creations 84

- The triumph of capital over labour 87

- The ravages of zero marginal cost 89

- Blockchains, killed in the back office 91

- The symmetry of deception 94

7. The institution crumbles 97

- The balance sheet never lies 98

- The ring-fencing riddle 101

- The liquidity sitting outside 103

- But we want to be banks too 106

8. Reimagining the product 109

- Mapping the birth of new products 110

- Dump the deposit account 112

- Credit in a capsule 116

- Rewriting the P2P playbook 119

9. The great transitions 123

- From tribes to networks 124

- LIBOR, again and again 129

- The next financial crisis… 132

10. Glossary, References and Index

Have you ever considered about adding a little bit more than just your articles?

I mean, what you say is important and all.

But think of if you added some great photos or video clips to

give your posts more, “pop”! Your content is excellent but with

images and video clips, this site could definitely be

one of the most beneficial in its niche. Very good blog!